Proof of completeness: How Cryptio’s new Data Integrity module prepares you for financial audits

Comprehensive guide for enterprises on how to ensure crypto data accuracy and completeness in financial reporting.

Crypto enterprises often struggle to find an auditor to take on their financial audit work. With increased SEC scrutiny, auditors see reputational and operational risks in taking on clients in the crypto industry.

It doesn't help that many crypto enterprises don't have their bookkeeping in order. There is a technical gap here - on-chain transaction histories are difficult to retrieve and format in a way that is useful for accounting and reporting. This leaves crypto enterprises and institutions at risk of inaccurate and incomplete financial records.

Cryptio’s Audit Readiness module seeks to transform this situation so that accountants and financial controllers can easily:

- Ensure the completeness and accuracy of their financial statements.

- Implement a range of internal controls to manage reporting risks.

- Streamline audit processes and lower fees with robust internal controls.

- Confidently undergo audits from reputable firms with ease.

Cryptio’s Data Integrity dashboard can be found within the Audit Readiness module. Users can identify and rectify data accuracy issues through balance, price, and cost basis discrepancy checks.

As a result, enterprises and institutions can efficiently manage and mitigate risks associated with data quality. While other crypto accounting softwares rely on explorers for data, Cryptio stands out as the only platform that ensures data integrity, with audit ready proof of completeness reports.

Let’s dive into why we built this module. If you're a crypto CFO or Financial Controller, this guide covers everything you need to know to ensure accurate on-chain transaction data when preparing for an audit.

The cost of financial audits spiral without internal controls and data completeness & accuracy checks

External or internal auditors need to examine documentation and records around an organization’s transactions and financial activity, including financial statements, supporting documents, receipts, invoices, and other relevant records.

Without the proper internal controls in place when preparing this documentation, organizations risk a prolonged audit which consumes additional resources, increases costs, and disrupts usual business operations. If they fail to provide this documentation with proofs of material completeness and accuracy, they will fail the audit.

These documents need to contain accurate and complete datasets of on-chain transactions alongside any that occur off-chain.

On-chain transactions are difficult to record in a useful way for financial reporting. The tools often used to retrieve on-chain financial data, such as block explorers or third-party data indexing companies, often result in errors or missing transactions. These tools are not built for accounting and audit use cases and therefore do not represent data in a useful way for accountants and auditors.

How to prove on-chain data completeness - the methodology

Cryptio’s back-office solution does not rely on block explorers or third-party indexing companies, which are prone to retrieving inaccurate and incomplete transaction histories.

Instead, our team has built our proprietary data infrastructure to retrieve entire transaction histories from 21+ chains. We run nodes across these chains and then index the retrieved on-chain data. Our indexers are purpose-built to filter for relevant accounting and financial reporting data.

Additionally, our Audit Readiness module bolsters our back-office solution, making it the industry-leading solution for accounting, reporting and audit preparation.

You can find the following 4 features in our Data Integrity tab.

1. Balance discrepancy check (known as Sanity Check in-app)

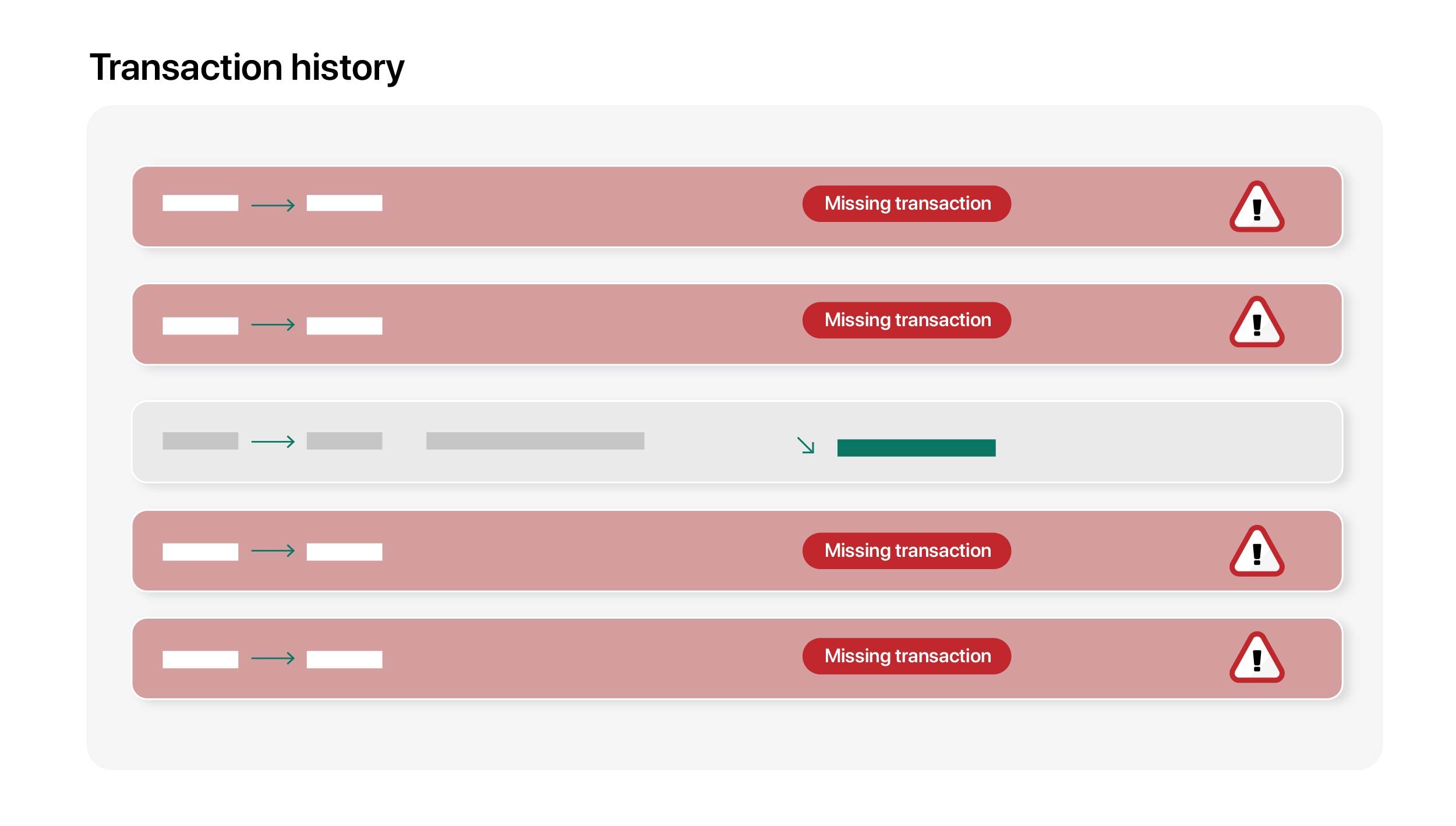

The balance discrepancy check flags missing transactions or incorrect data. If you run a balance check, the platform balance is compared to the live on-chain balance (via self-hosted nodes, third-party nodes or explorers). You can see discrepancies on a wallet-by-wallet basis and work to remove material discrepancies within the Data Integrity dashboard.

2. Prices discrepancy check (known as Sanity Check in-app)

Cryptio automates the valuation of crypto assets in fiat (USD, GBP, EUR, etc). For new or low market cap tokens where a price is not readily available - Cryptio flags these transactions so a pricing feed can be sourced or manually added.

The check provides you with a complete list of any transaction that is missing a fiat value. It is not necessary to always have a fiat value attached to every transaction. For example, spam tokens do not necessarily need to be priced. The goal is to remove material discrepancies from legitimate assets. Cryptio highlights any top 100 Market Cap assets that have not been priced so they can be addressed.

3. Cost basis discrepancy check (known as Sanity Check in-app)

Each time an asset is disposed, we compute the cost basis based on the chosen methodology (WAC, FIFO, LIFO, HIFO).

The Cost Basis Sanity Check identifies missing volume errors by scanning the transaction history for every wallet.

4. Manual Data tracker

Within the Data Integrity tab, you can use the Manual Data tracker to record where you have uploaded or made adjustments to transactions and prices. This is crucial for any auditor.

This data is divided into outflows, inflows, and fees flows. Additionally, you can view critical information about the modified transactions such as the wallet it belongs to.

The Manual Data report contains information that can be submitted to an auditor as part of the financial documentation.

Internal controls at every stage of the accounting workflow

As a financial controller, it is imperative that you minimize errors and diligently document any discrepancies that arise during the following stages:

- Data collection stage: Check for missing transactions or incorrect transaction data.

- Valuation stage: Accurately price all transactions to ensure precise financial reporting.

- Cost basis: Calculate the cost basis correctly, ensuring proper identification of matching counterparties.

- Manual data: Track and record any manual adjustments made to prices and transactions.

To assist accountants and financial controllers at crypto enterprises and institutions, Cryptio has released the Data Integrity dashboard—a comprehensive solution that enables meticulous monitoring of these four data management stages.

Empowering enterprises and institutions with Cryptio's data integrity dashboard

Cryptio's Data Integrity dashboard is an essential tool for enterprises and institutions seeking accuracy and completeness in their financial data as they prepare for audits. With built-in discrepancy checks, financial controllers and accountants can swiftly identify and rectify missing or inaccurate data.

While Cryptio's proprietary data infrastructure retrieves comprehensive transaction histories, there are instances where specific transaction details, such as price or cost basis, may be absent. To ensure meticulous audit preparation, it is crucial to minimize errors and document any discrepancies with clear explanations.

By leveraging the Audit-Readiness module, businesses can significantly reduce the risk of extended audits, which can result in increased resource allocation and potential reputational harm.

By embracing audit readiness, organizations demonstrate their commitment to transparency, accountability, and adherence to regulatory requirements. This enables them to effectively address audit inquiries and ensure a smooth audit process.

Cryptio is supporting 350+ of the industry’s leading companies through their audits, including ConsenSys (MetaMask), 1inch, Tezos Foundation, and NEAR Foundation.

Curious if we can help you with getting audit-ready? Book a demo today.

-1.png)