Crypto Audit Insider: The definitive guide to financial reporting and audit readiness

Contributions from David Byrd (EY), Steven Baum (Marcum), Alexis Tandéo (PwC) and Nicholas Newman (Harris & Trotter LLP).

Crypto audits can be challenging. Obtaining complete and accurate financial data from blockchains is difficult, increasing the likelihood that finance teams will struggle to complete their reporting to the high standard that auditors require. In addition to this, there are many technical and regulatory complexities that need to be addressed before going through an audit.

Robust internal controls are needed to mitigate all the risks that you might face as an organization dealing with digital assets. However, digital assets present a new paradigm for back-office teams. There remains a knowledge gap in many finance teams that may not understand the specific internal controls needed to mitigate the risks associated with on-chain transactions.

Cryptio has interviewed four experts at EY, Harris & Trotter LLP, Marcum and PwC to create a guide to help you navigate these questions. In our Crypto Audit Insider series, we cover:

- How to structure your team for audit success

- Expected internal controls for data completeness and accuracy

- Building vs. Third-party Software: Setting up an auditable back office

- Internal controls for custody, treasury operations & payments

Introduction to our auditors (EY, Marcum, PwC, Harris & Trotter LLP)

We sat down with four auditors from leading firms to write the complete guide to prepare for crypto audits.

David Byrd is a Partner at EY and the firm’s Blockchain Strategy Leader for Assurance. His role involves guiding asset managers, banks, exchanges, and custodians in achieving their goals within the blockchain and digital asset landscape. Leading EY's Digital Asset Research Center, he oversees teams dedicated to supporting Assurance, Tax, and Consulting initiatives. With an in-depth technical grasp of blockchain technology and custody solutions, David actively contributes to the development of digital asset tools used by EY for audit and audit readiness engagements. Additionally, he communicates with regulators worldwide and prominent industry associations to exchange insights and foster best practices in the realms of accounting, auditing, compliance, and digital asset valuation.

Steven Baum is a Partner at Marcum and is leading its blockchain audit and consulting practice, where he supports a range of players in the industry including investment funds, lenders, exchanges, brokers/dealers to mining companies, token issuers, and custodians. His breadth of experience includes: overseeing private company and SEC audit engagements; auditing companies working with distributed ledger technology; and advising on complex accounting transactions such as token launches and ICOs.

Alexis Tandéo is a Director at PwC in its Digital Assets Trust Services practice. He provides various services to institutional clients, corporate and startups to help them navigate the challenges of digital asset management. He supports some of the industry’s largest players in implementing internal controls that address the risks inherent in businesses leveraging digital assets. Additionally, he consults on financial reporting compliance requirements for companies operating in the crypto realm and provides accounting and regulatory reviews.

Nicholas Newman is a Partner & Head of Digital Assets at Harris & Trotter LLP, leading the firm’s digital assets practice. He works with some of the most prominent entities in the crypto industry including 1inch, Wintermute, and Blockchain.com, supporting them with audit, advisory, accounting, bookkeeping, compliance, and taxation services. With expertise in crypto and audit, he shapes regulatory frameworks and collaborates globally as an independent member of BKR and community-led interest groups like Web3CFO. Nicholas champions Harris & Trotter LLP's innovative Proof of Reserve service powered by Chainlink, ensuring transparency in clients' on-chain and off-chain reserves, bolstering their financial credibility.

Guide to good design of internal controls

Over the course of our Crypto Audit Insider, we will discuss specific internal controls to mitigate specific risks. But how do you design robust internal controls? They are essential to mitigating risks that you face as a business. You need to demonstrate that they are effective in your audit documentation - otherwise, you will likely face a prolonged audit or you will risk failing it entirely.

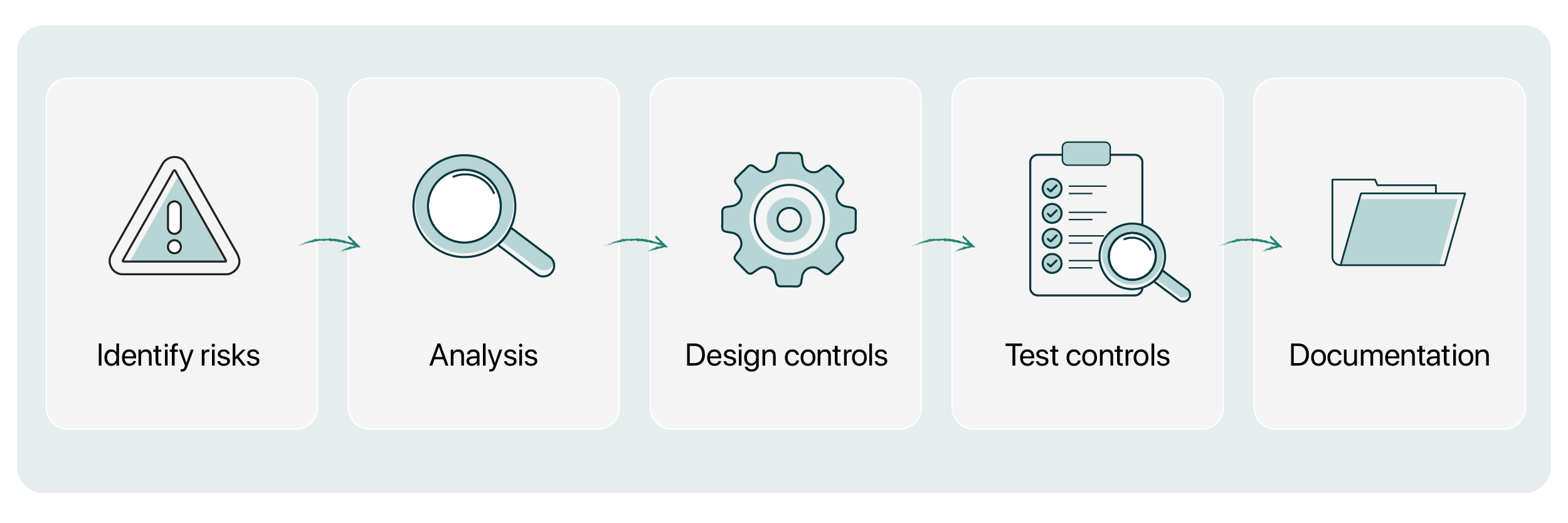

Alexis Tandéo from PwC recommends the following process:

- Conduct a rigorous risk assessment.

- Design and implement relevant control activities to mitigate the risks.

- Document the controls with a clear audit path.

“As auditors, we are required to understand the entity and its environment, and in particular the control environment relevant to the preparation of the financial statements. In this perspective, we shall, before the audit, evaluate whether the key controls are designed effectively to address the risk of material misstatement and determine whether the controls have been implemented. In practice, in addition to the inquiry of the entity’s personnel, we will test for example one instance of each relevant control to conclude our assessment and then decide whether we rely on these controls in our audit strategy.”

Where auditors cannot rely on the controls - whether because of poor design or inadequate testing - they carry out substantive testing. This subjects your internal controls to more detailed testing that takes longer and increases the cost of audit.

Empowering companies to be always audit-ready

In the ever-shifting landscape of digital assets, attaining audit readiness is a continuous process, requiring proactive adaptation to the latest industry standards and regulatory developments. The knowledge shared in this series serves as a valuable resource for navigating the complexities of crypto audits and ensuring your financial operations meet the highest standards of accuracy and compliance.

Need help preparing for an audit?

Click here to speak to one of our experts today - no strings attached.

.png)