CFO Outlook: Navigating crypto and macro cycles

Key takeaways

- Building resilient revenue streams: Diversification of revenue, especially sources that deliver revenue in down cycles (eg. custody, infra) are crucial for weathering challenging market conditions.

- Robust risk management: Maintaining a cash buffer, planning for asset volatility, and stringent counterparty assessment.

- Regulatory parity for TradFi and crypto: Applying established TradFi frameworks, such as attestations for stablecoins, could provide clarity and competitive advantage for crypto enterprises in a stricter regulatory landscape.

- Challenging IPO environment: With fewer companies going public, our panelists discussed which crypto companies should consider an IPO and explored alternative shareholder liquidity options.

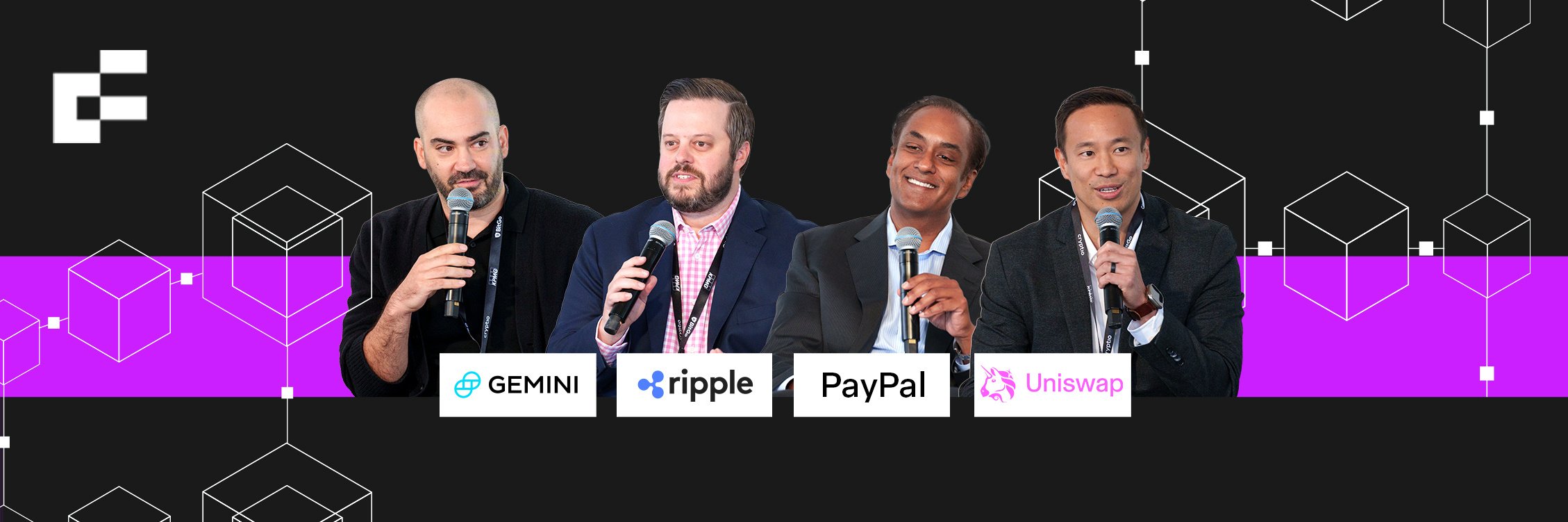

Panelists

- Jon Bilich, CFO - Ripple

- Rob Loban, CAO - Gemini

- Neil DeSilva, former CFO - PayPal

- Justin Wong, VP Finance - Uniswap Labs

- Antoine Scalia, CEO - Cryptio

Building resilient revenue streams

The panelists highlighted the importance of diversifying revenue streams as a crucial strategy for scaling their companies amid challenging market conditions. Justin emphasized that fees generated from the Uniswap interface are a key revenue driver, providing a stable income source even during market volatility.

He also explained the additional benefits of diversification: “By broadening our product lines, we can meet the needs of different market segments and reduce our reliance on a single source of revenue.”

Jon shed light on Ripple’s acquisition of Swiss custodian Metaco last year which has diversified Ripple’s business lines through its subscription revenue from clients such as HSBC, BBVA, and DBS.

Continuing to build in a downturn can be tough, but Justin shared that Uniswap employs multiple strategies to stay agile, including diversifying its revenue, maintaining operational discipline, and prioritizing long-term innovation. These tactics help the company remain resilient while positioning itself to take advantage of market rebounds.

Jon emphasized the need for a cash buffer to ensure the company can weather unexpected challenges while continuing to scale. By maintaining a strong cash position and exploring diverse revenue sources, companies can help businesses weather challenging market conditions but also pursue more aggressive growth strategies when opportunities arise.

He explained: “The cash buffer that we keep on our balance sheet is probably very different from what you would in a non-crypto business. It’s maintaining that really healthy cushion to weather the ups and the downs, so that you can keep building when the markets are challenging.”

Managing risk and compliance in crypto

CFOs play a critical role in building trust with stakeholders—whether they’re customers, investors, or internal teams—by ensuring financial transparency, maintaining regulatory compliance, and establishing robust risk management.

Counterparty risk

The collapses of companies like FTX and SVB have underscored the prevalence of counterparty risk in the crypto industry. While counterparty challenges aren't exclusive to crypto, they are particularly widespread within the sector.

Justin pointed to stablecoin lending as an example, where the promise of high returns attracted many investors, but both counterparty risk and concerns about the underlying assets backing the stablecoins became significant issues. The collapse of FTX brought down other companies, with many investors in the stablecoin lending space losing their principle.

Justin urged caution, saying that “Where there are returns well in excess of market returns, this often signals additional risks”.

Compliance risk

Crypto enterprises in the U.S. are under heightened scrutiny as the SEC intensifies investigations, creating a more demanding regulatory environment. The panelists voiced concerns about the lack of regulatory clarity, which complicates efforts for companies to identify and implement best practices.

They also highlighted the absence of a definitive framework from regulators to guide exchanges and stablecoin issuers in developing proof-of-reserves reporting and audit initiatives.

Rob pointed to the regulatory confusion on this topic, stating, “Those proof-of-reserves audits are all over the place in terms of what certain regulators want or expect. Until we have a clear framework and until we have a clear auditing standard put up with a PCAOB or some standard like that.”

This regulatory uncertainty, particularly in the U.S., is also straining the relationship between crypto enterprises and banks, making it harder for crypto companies to operate.

Neil expressed the benefits of implementing existing frameworks for TradFi businesses, particularly attestations for stablecoins.

He stated “Attestation is a competitive advantage. Bringing the best from TradFi makes a ton of sense to me.”

Ensuring financial transparency

CFOs can build trust and transparency by providing clear visibility into financial statements, ensuring stakeholders have access to accurate, detailed insights into the company’s financial health and performance.

Rob pointed out that the current regulatory environment is promoting caution among crypto exchanges.

He explained: “There are still a lot of crypto exchanges that are not audited or are audited, but you can’t see the public transparent information. The reason you can’t do that is because everyone’s scared of saying something and trying to be transparent.”

He also shared insights into Gemini’s strategy for instilling customer confidence by offering transparency around the company's underlying balances and crypto holdings, stressing that trust among customers is crucial for a business.

Jon emphasized the importance of breaking down the business's performance into specific, detailed metrics to build trust in financial reporting. He recommended sharing precise figures, such as transaction volumes and growing margins, to provide clarity and transparency. These insights are crucial not only for internal teams but also for investors and external markets. Additionally, Jon advised tracking how these metrics fluctuate with crypto market volatility, as this level of transparency is essential for fostering trust in the company’s financial health.

Going public in a challenging IPO environment

The panel was divided on the topic of going public. Ripple and Uniswap expressed that they do not intend to go public in the near future, whereas PayPal has already been a public company for over two and a half decades. Fewer companies are choosing to IPO. In 2019, over 1000 companies went public, this year there were only 150 IPOs.

Neil highlighted the positive effects of public markets, which include:

- They have a disciplinary element on management teams and boards

- They create jobs - particularly in financial services.

- They create wealth by allowing people to participate.

Drawing from his experience at BlockFi, Rob explained that the company wanted to become public as it aimed to maximize transparency in its financials, ensuring that stakeholders had a clear understanding of its overall financial health. This sentiment was echoed by Jeremy Fox-Geen, CFO of Circle, later at Crypto Finance Forum who explained Circle’s reasons for pursuing an IPO (see his conversation with Cryptio’s CEO Antoine).

While an IPO can offer access to capital and boost credibility, it comes with significant challenges, particularly heightened regulatory scrutiny and costs.

Rob stated "You have to have a very compelling reason to go public right now because you are exposing yourself to uncertainty and costs that can be overwhelming.”

While going public is one route to creating liquidity for shareholders, businesses can explore alternative methods to achieve the same goal. Jon explained that even though Ripple has not become a public company, it has focused on offering various shareholder liquidity opportunities such as tender offers.

Building trust and navigating financial complexity

Whether you’re a CFO of a business looking to go public or not, ensuring transparency and auditability of financial statements is key to building long-term trust among stakeholders.

Cryptio supports CFOs in navigating these challenges—whether it's preparing for an IPO or managing risk and compliance. Our platform ensures:

- Seamless financial reporting for US GAAP and IFRS.

- In-built suite of internal controls to ensure compliance with regulatory authorities (SEC, FASB, MiCA, VARA).

- Automated reconciliation for exchanges, banks, custodians, stablecoins, ETFs.

Get in touch to learn more about how we can help your company thrive.