Banks and Custodians: De-risking your digital asset products in 2024 with Fireblocks, Coincover, AlphaPoint and Notabene

Financial and ops leaders are constantly seeking strategies to manage risks associated with digital assets. Our recent webinar, Banks and Custodians: De-risking Your Digital Asset Products in 2024, provided invaluable insights for CFOs, reconciliation specialists, COOs, compliance leads and Heads of Crypto/Digital Assets. Hosted by an esteemed panel of industry experts including:

- Fireblocks - Alexandre Chessé, Head of Sales, France, Middle East, Africa

- AlphaPoint - Tristan Thoma, Director of Govt. and Payments

- Notabene - Lana Schwartzman, Head of Regulatory Compliance

- Coincover - Oliver Cummings, Director of Sales

- Cryptio - Jeff Rundlet, Head of Accounting Strategy

The discussion delved into practical solutions and cutting-edge approaches for mitigating risks in the digital asset space.

Exploring expert strategies: A deep dive into digital asset risk management

The digital asset market has seen explosive growth in custodial solutions, characterized by all-time highs in crypto assets and increased corporate adoption. As Jeff Rundlet, Head of Accounting Strategy at Cryptio, – highlighted, "we see real investment, real adoption, but this adoption and this rapid growth comes with real risks that all custodians and banks must mitigate."

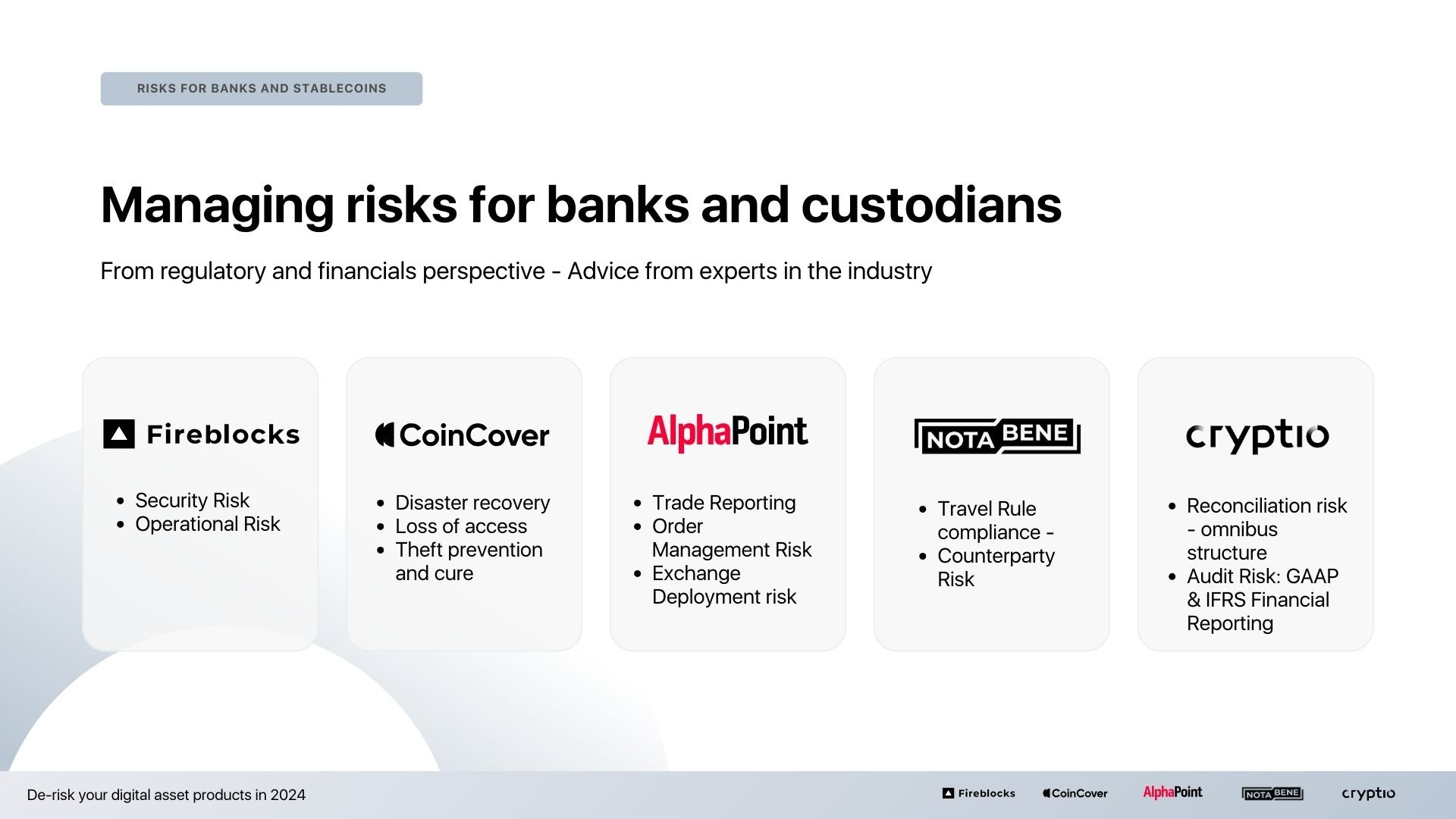

The webinar explored essential topics such as custody risk, disaster recovery, transaction monitoring, compliance obligations, and the importance of an integrated tech stack solution to address the multifaceted risks in the digital asset industry. Underlining the importance of specialization and collaboration among tech providers to cover the full spectrum of risk management effectively.

Fireblocks' blueprint for digital asset safety

.jpg?width=1920&height=1080&name=Derisking%20digital%20assets_Q1%20Webinar_10Jan24%20(1).jpg)

Alexandre Chessé, Head of Sales, France, Middle East, Africa at Fireblocks – discussed Fireblocks' role in enhancing security for digital assets. He described how Fireblocks, with its roots in cybersecurity, aims to "enable every business to easily and securely support digital assets and cryptocurrencies."

Alex delved into the significance of wallets in blockchain-based operations, explaining Fireblocks' development of an MPC (Multi-Party Computation) technology stack that supports both self-custodial and non-custodial wallets - “Everything that is blockchain-based starts with a wallet... we’ve basically built an MPC stack.”

This approach allows Fireblocks to cater to various use cases, including custody, tokenization, trading, and payments, while adopting a security-first mentality to tackle operational and regulatory risks.

Coincover’s comprehensive approach to blockchain protection

.jpg?width=1920&height=1080&name=Derisking%20digital%20assets_Q1%20Webinar_10Jan24%20(2).jpg)

Oliver Cummings, Director of Sales, Coincover – highlighted Coincover's mission to create a secure blockchain environment, enabling users to manage crypto assets safely. He introduced Coincover as a pioneer in blockchain protection, offering a suite of technologies designed to safeguard assets against a range of threats, from human error to cyberattacks.

“We create unique biometric security protocols with you to ensure that only you and those approved by you will be able to access your secure backup. Working seamlessly, silently and in real-time, we protect your account on each and every transaction that takes place.”

Oliver explained Coincover's unique blend of preventive measures and insurance-backed solutions, emphasizing the importance of disaster recovery. By eliminating single points of failure and providing secure backup solutions, Coincover aims to ensure that users' assets are protected at all times.

AlphaPoint’s blueprint to streamlining crypto exchange security and compliance

.jpg?width=1920&height=1080&name=Derisking%20digital%20assets_Q1%20Webinar_10Jan24%20(3).jpg)

Tristan Thoma, Director of Govt. and Payments, AlphaPoint – provided insights into AlphaPoint's efforts to de-risk digital assets, particularly focusing on the role of exchanges. He explained how AlphaPoint offers white-label infrastructure for crypto exchanges, integrating seamlessly with partners to ensure a compliant and user-friendly experience.

“Our goal is to integrate cryptocurrency into day-to-day life, we know and understand that legacy financial institutions have very strict compliance and reporting, in particular for exchange settlement. So that is a lot of the core values that AlphaPoint provides.”

Tristan detailed how AlphaPoint's services extend beyond exchanges to include liquidity management, payment solutions, and wallet integration, stressing the importance of compliance and efficient trade management in mitigating risks.

Notabene’s strategic approach to crypto transaction integrity

Lana Schwartzman, Head of Regulatory Compliance, Notabene – tackled the crucial topic of compliance, specifically addressing the challenges and solutions related to the Travel Rule. She introduced Notabene as a leader in pre-transaction risk management, enabling institutions to identify and prevent high-risk activities before they occur.

.jpg?width=1920&height=1080&name=Derisking%20digital%20assets_Q1%20Webinar_10Jan24%20(4).jpg)

“The Travel Rule provides an essential layer of oversight in this rapidly growing cryptocurrency market. It proactively can stop potential listed transactions before it is settled on the blockchain by giving virtual asset service providers (VASPs) the ability to reject and not accept the transaction from even coming onto their platform, and so reducing this overall AML and sanctions exposure. And this is why Travel Rule should be part of a healthy compliance stack for effective AML controls.”

Lana's discussion dove deep into the complexities of compliance in the digital asset space, highlighting the importance of technology and processes that can adapt to the novel challenges posed by crypto transactions.

Elevating financial reporting and compliance with Cryptio

Jeff introduced Cryptio as the cornerstone for financial and compliance reporting within the digital asset ecosystem. Cryptio's mission is to consolidate digital asset data across an organization into a unified data lake, underpinned by SOC 1 and SOC 2 certifications. This process addresses the foundational problem of data management and access, crucial for performing complex calculations and managing vast transaction volumes. "Cryptio is built on in-house proprietary data infrastructure where we integrate and index the majority of the blockchains that we support.” Cryptio supports 40+ blockchains and integrates with a myriad of liquidity and custodian providers, as well as ERP systems like Oracle and SAP.

.jpg?width=1920&height=1080&name=Derisking%20digital%20assets_Q1%20Webinar_10Jan24%20(5).jpg)

A core feature of Cryptio is its sophisticated reconciliation process for both on-chain and off-chain balances, ensuring data completeness and accuracy essential for reliable financial reporting. "Until you understand that you have complete and accurate data, your financial reporting and compliance reporting won't be accurate," – underlining the importance of Cryptio's capabilities in verifying transaction details and balances.

Fireblocks, Coincover, AlphaPoint, Notabene and Cryptio: The complete stack for regulated businesses

.jpg?width=1920&height=1080&name=Derisking%20digital%20assets_Q1%20Webinar_10Jan24%20(6).jpg)

This webinar provided a detailed exploration of the strategies and technologies financial leaders can employ to navigate the digital asset landscape safely. Each speaker contributed unique insights into their specialized areas, collectively offering a comprehensive view of how to manage and mitigate the risks associated with digital asset operations.

As the sector continues to evolve, the integration of these strategies will be vital for ensuring the secure and compliant management of digital assets. Cryptio's deep integration with the tech stacks of exchanges, custodians, and other financial tools, coupled with its collaboration with industry peers like Notabene, AlphaPoint, Fireblocks, and Coincover, positions it as a central node in the digital asset risk mitigation ecosystem.

To watch the full webinar visit the Cryptio YouTube channel.

Table of contents

- Exploring expert strategies: A deep dive into digital asset risk management

- Fireblocks' blueprint for digital asset safety

- Coincover's comprehensive approach to blockchain protection

- AlphaPoint's blueprint to streamlining crypto exchange security and compliance

- Notabene's strategic approach to crypto transaction integrity

- Elevating financial reporting and compliance with Cryptio

- Fireblocks, Coincover, AlphaPoint, Notabene and Cryptio: The complete stack for regulated businesses

%20%20(2)%20(1).png)