SOC-compliance and enterprise security: a deep dive into crypto accounting software with Cryptio

In an era of digital transformation and the surging adoption of cryptocurrencies, crypto accounting software has become a vital component of the tech stack for institutions and enterprises managing complex financial ecosystems.

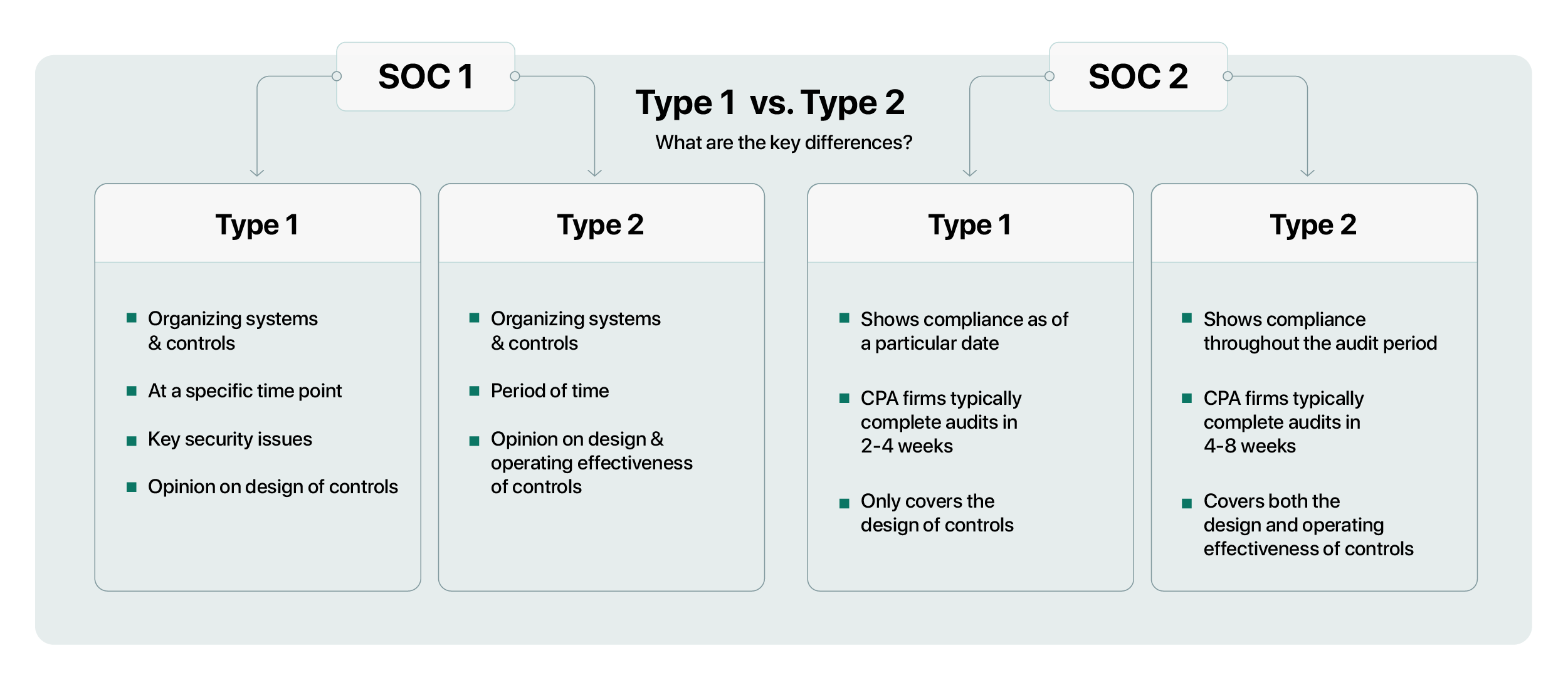

In this rapidly evolving crypto landscape, ensuring the integrity and security of financial data is imperative for businesses that want to pass audits. One of the key components of being audit ready are SOC (Service Organization Reports) reports, specifically SOC 1 and SOC 2 Type 1 and Type 2 compliance.

In this blog, we delve into the differences between SOC 1 and SOC 2 reports, look at the key ways in which the SOC report enables audit readiness for crypto businesses and enterprises, and how Cryptio is setting the industry standard for SOC compliance and secure crypto accounting software.

The difference between SOC 1 and SOC 2 reports

SOC 1 and SOC 2, created by the AICPA, are essential standards for evaluating internal controls in service organizations. SOC 1 focuses on financial reporting controls, while SOC 2 assesses a broader range of controls, including security, data availability, processing integrity, confidentiality, and privacy. While SOC 1 is crucial for financial data accuracy, SOC 2's significance lies in ensuring operational security and the protection of sensitive information for software providers.

How SOC reports safeguard financial data in crypto accounting software

By undergoing SOC 1 and SOC 2 audits, crypto accounting software providers can demonstrate their commitment to security, integrity, and confidentiality, providing users with assurance about the reliability and trustworthiness of their systems.

Let’s take a look in more detail at the 5 different benefits of a SOC-compliant crypto accounting software for its users.

- Data Integrity and Accuracy: Crypto accounting software is entrusted with vast volumes of financial data, where precision is paramount. SOC 1 compliance reaffirms the software's ability to record and report financial information correctly, reinforcing the accuracy and trustworthiness of financial statements.

- Security Assurance: The crypto industry is an enticing target for cyberattacks and data breaches. SOC 2 compliance ensures that the software provider has implemented robust security measures to shield sensitive data. This is especially vital when handling digital assets and safeguarding private keys.

- Client Trust: Institutions and enterprises place their financial data in the hands of crypto accounting software providers. SOC compliance serves as third-party validation of the software's controls, instilling confidence in clients and investors who depend on the software's reliability, security, and data accuracy.

- Regulatory Alignment: Compliance with evolving financial reporting standards and data protection regulations is imperative. SOC 1 and SOC 2 compliance helps software providers meet these legal and regulatory obligations, reducing the risk of non-compliance and the associated legal consequences.

- Competitive Edge: In a competitive landscape, SOC compliance differentiates software providers. It signifies a dedication to security and data integrity, positioning compliant providers as the preferred choice for institutions and enterprises seeking dependable crypto accounting solutions.

Cryptio: setting the industry standard for SOC-compliant and secure crypto accounting software

For any institution or enterprise operating in the crypto industry, aligning with a SOC-compliant crypto accounting software provider is an essential strategic decision. Financial data transparency is critical for the digital asset space – SOC 1 and SOC 2-compliance help crypto business and institutions achieve security and operational excellence.

.png?width=2501&height=2178&name=SOC%20Blog_image%203%20(2).png)

Cryptio is SOC 1 and SOC 2 Type 1 and Type 2 compliant. For the period of 2022 - 2023, our controls designed by one of the Big Four and audited by Aprio, a business advisory and accounting firm. Cryptio’s controls include additional controls focusing on 3 key factors:

- Indexers and Price Providers: Ensuring the safeguarding of your on-chain data infrastructure.

- Accounting and Integrations: Guaranteeing the security and reliability of your general ledger and crypto subledger connection.

- Reports: Tailoring our GAAP and IFRS-compliant reports to meet the unique needs of enterprises and institutions. For more information on reports, contact our team.

Compliance and security: the future of crypto accounting

This blog explored SOC 1 and SOC 2 compliance, emphasizing its critical role in reinforcing accuracy, security, and client trust. At Cryptio, we’re SOC 1 and SOC 2 Type 1 and Type 2 compliant and have also gone the extra mile by implementing controls audited by KPMG and Aprio.

These controls extend to key factors such as indexers, price providers, accounting integrations, and customized, compliant reports. For institutions and enterprises seeking operational excellence and security in their crypto accounting, Cryptio may be the solution you need. Take the next step in ensuring the reliability and trustworthiness of your financial software – book a demo with our team to experience firsthand the impact of SOC 1 and SOC 2 compliance with Cryptio.