New FP&A Module: Streamline cashflow reporting for regulated crypto enterprises

Visualize your crypto revenue and expenses to make strategic business decisions

What makes crypto FP&A especially challenging

To counter the volatility of crypto assets, crypto CFOs have added responsibility to ensure their organizations' income and savings at all times meet both near-term expenses and longer-term strategic investments.

To accurately manage cashflow, companies like miners need transparency for their projected hashrate vs. expected value. Centralized exchanges must project asset volume vs. revenue changes. Wallet providers need to forecast revenue from different aggregators.

Moreover, revenues generated in cryptocurrencies require additional accounting and valuation treatments before they can be normalized into existing cashflow reporting procedures. These treatments not only focus on reflecting the fair value of the crypto asset, but also identification of the financial activities across blockchains, custodians, and exchanges. This blog will look at the solutions for these challenges with the help of Cryptio’s FP&A module – let’s dive in.

Optimizing revenue and expenses for effective digital asset management

In crypto, calculating revenue and expenses has no source of truth to rely on. Gathering a complete record of transactions across different chains, DeFi protocols, and smart contracts to make them suitable for accounting standards is challenging. With the sheer number of blockchains, associated crypto wallets, and custody solutions – this information is often scattered.

Let’s take the use case of a swap aggregator, such as 1inch. As one of the leading aggregators of liquidity, they have $470B+ volume, 15M+ users, and 86M+ total trades. 1inch manages trades across hundreds of decentralized exchanges (DEXs) on multiple networks. It requires a complete and transparent reflection of swap routing revenue and DEX fee collection.

A swap aggregator would want to gather:

- Actual revenue from different DEXs to project targets, and

- Fees across networks as individual line items for forecasting budgets.

%20(2).png?width=5000&height=5834&name=FP%26A_Image%20blog%20(GEN-398)%20(2).png)

This example illustrates the complexities of revenue management in crypto, which we at Cryptio can help optimize.

Leverage your core accounting data for FP&A

Cryptio offers a battle-tested revenue stack that can help crypto CFOs project revenue and optimize expenses. These capabilities are supported by:

1. Complete and accurate blockchain dataCryptio runs nodes to gather all activity on a blockchain by building our indexers to filter through accounting and tax necessary activities. Cryptio can sanity-check the transaction data in the database. Cryptio is the market leader in blockchain data completeness. For more details, read our Counting Crypto blog series here.

2. Automated transaction categorizationAt Cryptio, our solution offers automated transaction categorization. Users only need to set up simple rules (e.g., if Customer custody sends a transaction to Treasury wallet A, then it’s a ‘Revenue’ account) to instantly recognize activities.

3. Counterparty identificationCryptio contact identification assists the revenue stack in reducing counterparty risk by identifying any materiality related to counterparties. This allows CFOs to be aware of any counterparty and minimize impact ahead of time.

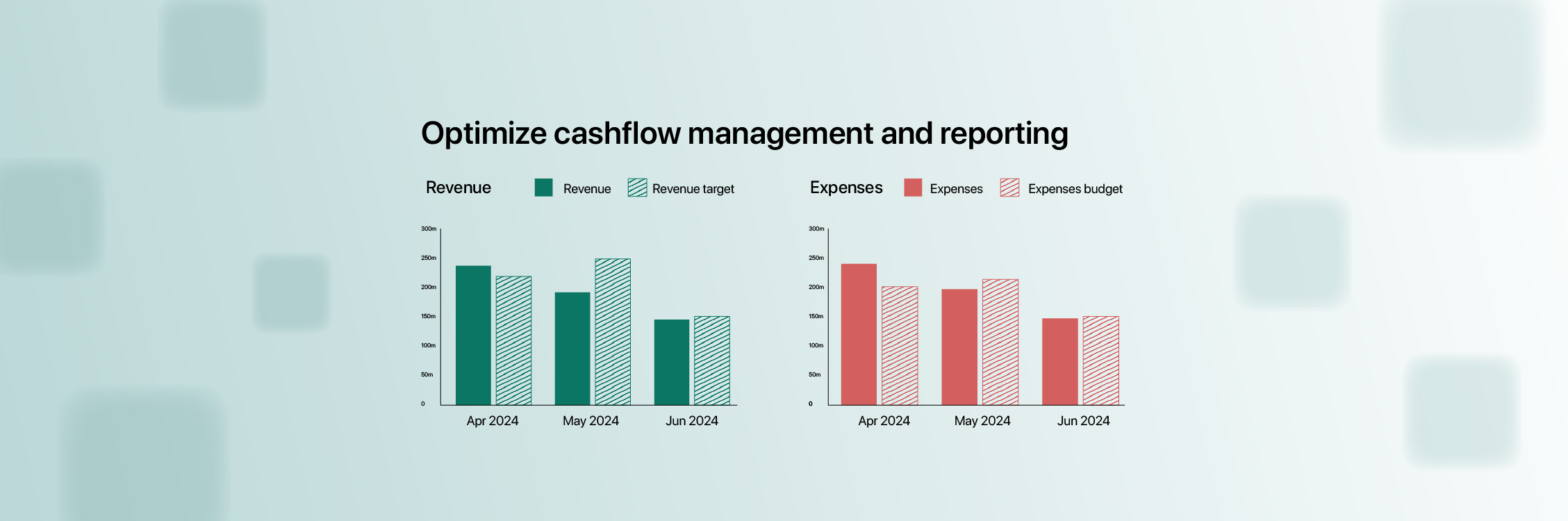

4. Financial planning and analysis moduleWith the strong foundation provided by the revenue stack, Cryptio's FP&A Module offers a comprehensive solution to these challenges, providing a historic source of truth for revenue and expenses with on-chain data visualized using labels and bar graphs.

This module not only shows the actual financial health, it also allows comparing actuals versus budgeted figures across various domains. Companies can create and track targets, and project future revenue using historical data by comparing as often as last 3 months of data to years back.

Why choose Cryptio's treasury management stack?

Effective revenue management is critical to navigating the financial complexities and risks associated with digital assets. Cryptio's revenue stack provides a robust solution, enabling CFOs and financial managers to forecast accurately, manage liquidity, and mitigate risks. Ensuring their organizations' financial health and strategic growth.

Join the ranks of innovative companies leveraging Cryptio’s advanced tools for optimized revenue management. Book a demo today and transform your approach to managing crypto assets.