Exchanges and custodians: Reconcile crypto settlements with an internal ledger system at scale

Introducing Cryptio AutoRec Engine: Reconcile asset movement and customer liabilities for high-volume business use cases.

Exchanges and custodians are at the core of global crypto adoption. These enterprises face significant complexities in managing and reconciling thousands to millions of off-chain transactions and on-chain data daily. Large exchanges and custodians often have the resources to build in-house solutions to manage the matching, record-keeping, and flagging of mismatched transactions. However, these often fall short, burdened by limited features due to resources and competing development priorities. Once variances are identified, drilling down through transactions to pinpoint errors is usually a manual and time-consuming process.

In this high-stakes landscape, where building trust and confidence are paramount, an on-chain source of truth becomes essential for enterprises. This is where Cryptio's AutoRec Engine comes into the picture, offering a lifeline to exchanges and custodians buried in complex data.

Untangling the complexities of crypto/settlement reconciliation

Exchanges and custodians manage customer trading activities across blockchains with the added complexity of tracking trades, deposits, and withdrawals. To circumvent the complexity of creating billions of deposit addresses, exchanges prefer to build omnibus infrastructure which allows businesses to group funds and minimize costs for their customers. However, omnibus infrastructure carries challenges from a financial auditability perspective of co-mingled funds of corporate treasury, customer assets, and liabilities.

To operate exchanges and custodians, companies manage data across disparate databases and the blockchain. Ensuring that liquidity providers (LPs), order management systems (OMS), and blockchain data are in sync presents complex challenges. For example, reconciling thousands to millions of line data from between liquidity providers, on-chain custody, and exchange OMS requires aligned identification/reference data next to each customer transaction record. This allows exchanges and custodians' internal teams to reconcile transaction history across LP database, OMS, and blockchain. However, this reference data is not usually present, and internal ledgers can be unstructured.

These institutions need a complete and accurate view of asset holdings, including detailed records of customer deposits and withdrawals. The goal is to achieve a "net effect" that accurately reflects asset holdings and available collaterals without exhaustive manual effort.

Operational control for exchanges and custodians

Introducing Cryptio's AutoRec Engine

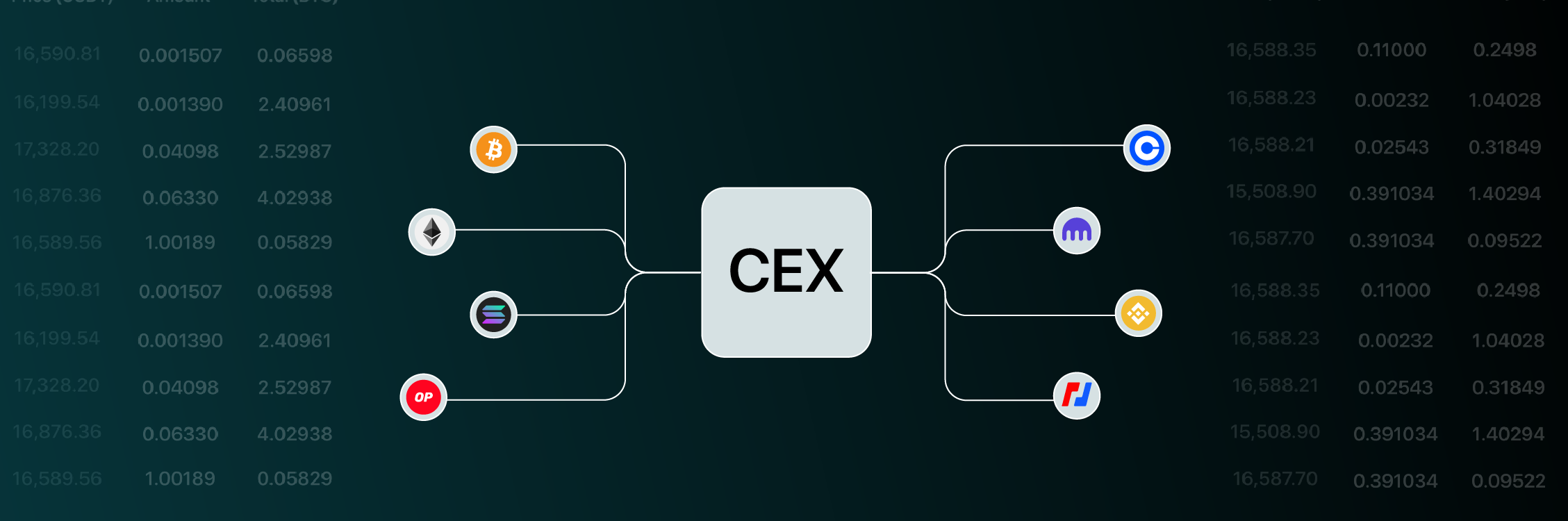

In response to these challenges, Cryptio developed the AutoRec Engine. Built on our proprietary data infrastructure relying on our nodes, indexers built specifically for accounting and financial needs, and databases designed to act as the ultimate on-chain source of truth for regulated enterprises. We support over 45 blockchains along with integration for 35+ exchanges, liquidity providers, and all major custody solutions. This allows exchanges and custodians to bring data into one platform and remove the need to build unique identifiers across all databases. Detailed tracking of trade execution, deposits, withdrawals, and virtual account balances are available once a connection has been built.

.png?width=1200&height=644&name=Image%202%20-%20AutoRec%20Blog%20(1).png)

AutoRec Engine offers reconciliation at scale. It provides efficient reconciliation for thousands to millions of transactions on a balance and transaction level for comprehensive audit trails.

The engine allows matching two databases, for instance, internal ledger systems with on-chain data at once based on customizable criteria.

Using AutoRec Engine, companies can batch balance reconciliation by:

- Time (either by hour or day);

- Transaction hashes;

- Transaction category;

- Notes;

This offers a high degree of flexibility and control, allowing custodians and exchanges to tailor the process to fit their specific needs. To further narrow down the matching attributes, companies can set further conditions like acceptable time and volume difference to recognise variances. The output from the AutoRec engine produces a detailed report of transactions that matched and flags any transactions that don't.

For example, exchanges and custodians can use transaction hash to identify the on-chain transfer, deposit and withdrawals. This then can be reconciled on a transaction-level.

Then, exchanges and custodians can use the AutoRec Engine to reconcile liquidity providers with the on-chain settlement to produce balance level reconciliation on all asset holding across on-chain sources vs internal database of customer records (Proof of Reserve).

The AutoRec Engine addresses not only daily reconciliation needs, crucial for maintaining compliance with regulations and applications for licenses (e.g. PSA (APAC), MTL (NA), and MiCa (EU), but also simplifies exception management and reduces the need for manual interventions.

Why choose Cryptio's AutoRec Engine?

In the world of cryptocurrency, reconciliation can be a complex, tedious task. But with solutions like Cryptio's AutoRec Engine, exchanges and custodians can automate this process, saving time and resources. The solution represents a leap forward in transaction reconciliation technology, offering:

- Automated, standardized processes that increase efficiency.

- The ability to handle high-volume transactions typical of large exchanges and banks.

- A system that flags unreconciled items, minimizing manual work and facilitating easy updates.

Join the ranks of trusted banks, exchanges, custodians, and brokers that rely on Cryptio's AutoRec Engine for their reconciliation needs and ensure compliance with ease. Book a demo today.