Finance leaders' guide to IPO readiness

Key takeaways

- Crypto IPO readiness goes far beyond listing mechanics - it demands institutional-grade finance infrastructure, disciplined operations, and cross-team coordination.

- Adaptable disclosures and transparent communication are critical to building investor confidence in an evolving, high-velocity industry.

- Modern investor engagement has shifted from one-off roadshows to continuous education, creating new expectations for storytelling and clarity.

- People, processes, and technology must advance in unison for crypto firms to meet public-company standards long before the bell rings.

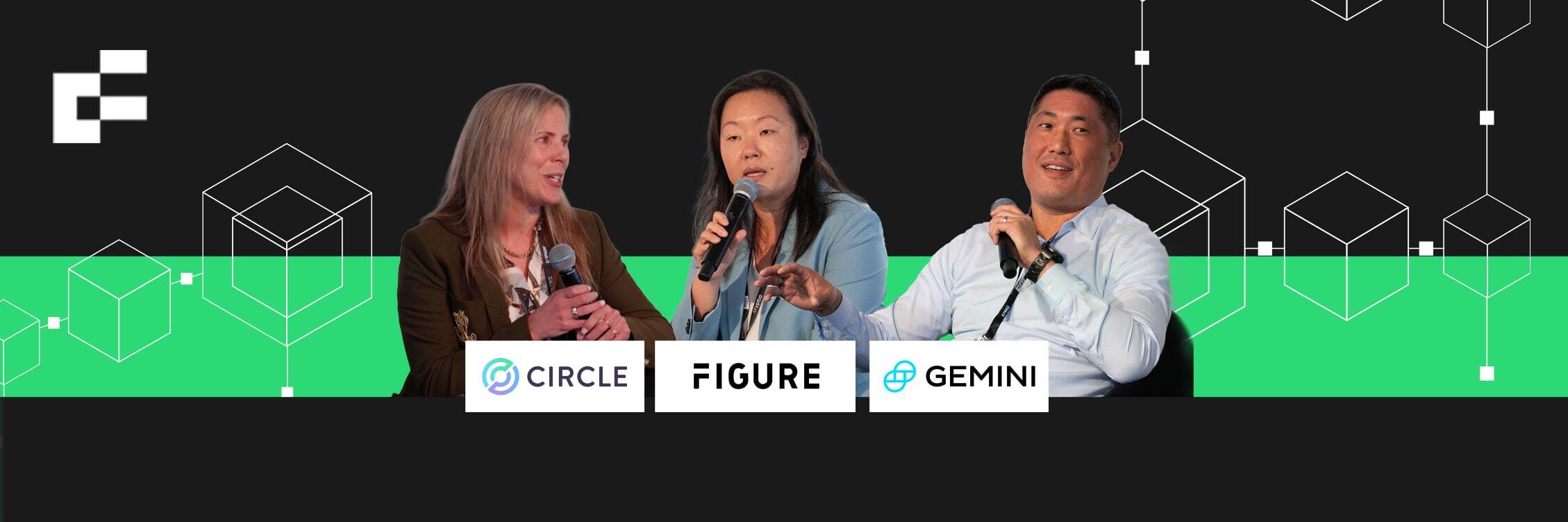

Panelists

- Tamara Schulz, CAO – Circle

- Dan Chen, CFO – Gemini

- Macrina Kgil, CFO – Figure

- Aamir Husain, Partner – KPMG (Moderator)

Crypto’s path to IPO readiness

Aamir Husain opened by reminding the audience that few sectors evolve faster than crypto and that pace reshapes what IPO readiness even means. For most crypto companies, the journey is less about meeting regulatory deadlines and more about building institutional credibility over time.

Tamara Schulz offered a candid account of Circle’s journey as one that stretched over multiple years before any filing. Circle filed its first S-4 in August 2021 and, over the course of that process, produced 18 draft registration statements, received 15 comment letters, and responded to more than 500 individual SEC comments. That extended engagement, she said, was grueling but transformative. It forced Circle to evolve far beyond its startup origins and embed public-company discipline at its core

“Because if you can’t reliably close your books and do it timely, then you’ll never meet what we would need to for IPO purposes… Excel spreadsheets could only take us so far. We knew we were not going to want to IPO in Excel.” — Tamara Schulz, Circle

Dan Chen added that the lesson for every crypto company is the same: readiness isn’t just a checklist but a mindset. What distinguishes serious contenders from aspirants is the willingness to operationalize transparency long before regulators demand it.

As a group, the panel agreed that IPO preparation has become a proving ground for organizational resilience. The work may be slow, but transformation at this scale depends on the right mix of people, processes, and technology.

People, processes, and technology: the IPO triad

The conversation naturally turned towards what could be referred as the real machinery behind IPO readiness - how different parts of the organization must work together as one engine.

Before building systems or optimizing workflows, companies must focus on assembling leaders who can scale, adapt, and stay steady through uncertainty. Schulz explained that IPOs create intense cycles of highs and lows, and it’s the leadership team’s emotional resilience that determines whether a company endures them.

Dan Chen of Gemini reframed the triad around a single truth: everything comes back to people. “Processes are only as good as the people who design and follow them,” he noted. A single person, he said, can transform even a modest setup – a $2,000 laptop and a good idea – into something world-changing. For Chen, this era of finance rewards thoughtfulness over tools, as he elegantly put:

“Your processes are only as good as the people that implement them or follow them. Your technology is only good as good as the people who select the right technology and execute and use it in an intelligent way. And if you follow those three threads, you always end up back with the people.”

Once the talent foundation is set, process becomes the next differentiator. For Schulz, this meant tightening the company’s ability to close books cleanly and on time because reliable reporting is the heartbeat of IPO readiness. Macrina Kgil added that in moments of transformation, especially during mergers, clarity of ownership is critical. When people don’t know who does what, processes collapse. Defining roles and aligning workflows ensures that accountability survives pressure.

But technology, the third pillar, is what ultimately ties people and process together. Schulz noted that Circle’s decision to overhaul its infrastructure – even implementing a new ERP mid-IPO – was a defining moment. The company recognized that legacy tools like Excel could no longer support the scale, speed, or assurance required of a public crypto enterprise. Instead, Circle invested heavily in automation, real-time data integration, and reconciliation across systems – ensuring that every number on its balance sheet could be trusted from transaction to audit, and allowing Circle maximum flexibility in their reporting – key to be being able to keep up with evolving requirements and regulations.

Figure faced similar challenges, operating at the intersection of multiple products and a live blockchain environment. Kgil explained that technology became their bridge between teams, helping standardize data and prevent errors during consolidation. Automated reconciliation tools and ledger systems enabled the company to confidently link on-chain activity with internal records – an approach echoed by peers like Circle, who use platforms such as Cryptio to independently attest and reconcile assets on-chain balances and internal data.

Reinventing the investor journey

Once a company’s internal engine is running smoothly, the next challenge is stepping into the public eye. And as the panelists agreed, the way crypto firms now engage investors looks nothing like it did even a few years ago.

The traditional IPO roadshow which was once a brief sprint of investor meetings before listing has evolved into a longer, more deliberate journey across industries. In today’s markets, investor education starts early and continues through “testing-the-waters” meetings that allow management teams to explain their model, gauge market understanding, and refine their messaging. This shift reflects a broader change in how companies build trust with investors, something that becomes even more critical in the crypto sector, where firms must translate complex, rapidly evolving business models into language and metrics that traditional investors can confidently understand.

“Back then, the roadshow was the key show. In recent years there is something called the testing-the-waters meetings… and these are really educational in getting the investors up to speed.” — Macrina Kgil, Figure

For crypto firms, the panel emphasized that these early engagements are no longer about persuasion, but about education. Many investors understand traditional balance sheets but lack sophisticated knowledge of how how crypto staking, lending and tokenization products actually work. That knowledge gap makes it essential for companies to invest time in explaining not just what they do, but how the mechanisms behind it create sustainable value.

Dan Chen explained that Gemini found success by making innovation measurable. Instead of leading with technical depth, his team focused on articulating how each product aligned with familiar financial concepts like yield, liquidity, and customer growth. He also noted that drawing parallels to established business models helped investors connect the dots — “We actually used consumer finance companies as comps for the KPIs we highlighted, and it was a way to explain the business in a crisp, compelling way.” Macrina Kgil echoed this, pointing out that as the industry keeps evolving, educating investors about the process becomes an ongoing responsibility rather than a one-time exercise

Framing the story for the public markets

Every great IPO, the panelists agreed, ultimately comes down to narrative. Investors dont just buy numbers but buy the belief: belief in the company’s purpose, its systems, and its staying power.

“When you're passionate about something, it’s easy to get lost in the weeds… Those technical elements matter, but only three questions really matter at the end of the day — what is your product, how is it different, and what can they expect?” — Dan Chen, Gemini

Chen’s three-question framework became the anchor for the discussion on storytelling. Tamara Schulz built on it by emphasizing that a company’s story must connect its technical competence to its mission that financial transparency, compliance, and innovation are not competing priorities but complementary narratives

In many ways, crypto remains an industry whose market sentiment has been shaped as much by perception as by performance. From high-profile failures such as the 2022 Terra–Luna collapse, and FTX scandal, and other moments of market excess, the sector has weathered skepticism and volatility. Yet, sentiment is now shifting toward renewed confidence and institutional support, with regulatory clarity emerging as a constructive force – helping distinguish serious, well-governed enterprises from speculative actors. As frameworks mature and transparency becomes the norm, the narrative has evolved: it’s no longer about proving that crypto deserves a place in the public markets, but about demonstrating that it can lead them.

The new playbook for crypto IPOs

By the end of the session, a clear framework had emerged: begin early, build deliberately, educate continuously. Circle’s journey showed how operational rigor underpins credibility. Figure demonstrated how collaboration and cross-functional design build adaptability. Gemini reminded the audience that clarity and focus remain the ultimate currencies of trust.

That discipline has paid off. All Circle Gemini and Figure saw their IPOs oversubscribed by 20–30x – a signal that the market’s appetite for well-governed, transparent crypto companies has never been stronger. Investors are no definitely rewarding maturity, structure, and proof of execution. Crypto’s next chapter will belong to those who can balance innovation with integrity transforming belief into long-term trust.

About Cryptio

Cryptio is the leading financial data platform for tokenization compliance, crypto accounting, and lending. Trusted by over 450 clients including publicly listed companies such as Circle, Exodus, Bitcoin Depot, and Semler Scientific. Cryptio delivers enterprise-grade infrastructure that translates complex on-chain activity into auditable, GAAP- and IFRS-ready financial records.

Discover how Cryptio can power your IPO-ready finance stack.