What does FASB's crypto fair valuation proposal mean for enterprises?

Financial Accounting Standards Board's (FASB) proposal for crypto reporting at fair value has huge implications for corporate crypto adoption.

As a CFO or finance leader at a crypto enterprise – how can you be prepared? This in-depth article will walk you through everything you need to know.

TLDR: What does the announcement mean on a high level?

- No more impairment charges. Businesses can hold their digital assets at fair value and recognize gains and losses immediately to reflect the true economics of the asset class. Most cryptocurrencies are eligible except for NFTs, specific stablecoins, and other tokenized assets & equities.

- This update is highly positive for the industry, especially for corporate and institutional adoption of digital assets. Companies previously faced challenges in reporting huge disconnects between carrying value and fair market value on their balance sheets - especially during times of high volatility and a future potential rise in prices.

- It is not effective immediately, but we can expect this guidance to be implemented in early Q2 2023.

What has FASB announced?

In a scheduled meeting on October 12th, 2022, the FASB ruled to move to a fair valuation method in accordance with ASC Topic 820 for digital assets. During the ruling, FASB member Gary Buesser commented “I’m looking at a chart for Bitcoin over the last year-and-three quarters – it’s ranged from twenty thousand to sixty thousand back to nineteen thousand ninety-six, so the only way to get any kind of real information on the holding of Bitcoin or Ethereum is through fair value.” This has been a long-time request by investors and companies alike, current impairment standards have been historically misaligned in presenting an accurate view of current asset valuations. Let’s take a deeper look at the details of the new ruling.

What is the current standard and what exactly is changing?

Current accounting guidance defines crypto assets as “intangible assets” and requires companies to present their valuations at historical cost less impairment. Due to the volatile nature of crypto assets, this has been a frustrating approach as companies now have to report these at essentially their lowest values with no ability to revalue them at a later date. It not only skews a company’s performance on its financials but more importantly, it reduces the extent to which these financials can be relied upon by an external audience. A major criticism against wider crypto adoption has been the lack of clear accounting guidance but also guidance that appears confusing at best, and inaccurate at worst.

The official decision was broken down into three points:

- Measure crypto assets at fair value, using the guidance in Topic 820, Fair Value Measurement.

- Recognize increases and decreases in fair value in comprehensive income each reporting period.

- Recognize certain costs incurred to acquire crypto assets, such as commissions, as an expense (unless the entity follows specialized industry measurement guidance that requires otherwise).

Moving to a methodology in accordance with Topic 820, Fair Value Measurement, assets will now record increases and decreases in fair value similar to traditional financial assets. This will be recognized in comprehensive income for each reporting period. A fair value approach is more aligned with the true economics of crypto assets and allows company financial records to reflect a more useful outlook for users of the information.

Here is an example illustration:

Tunde purchased 1 ETH for $100 on 5/1. The price of ETH fell to $75 on 5/31 and increased to $200 on 6/30.

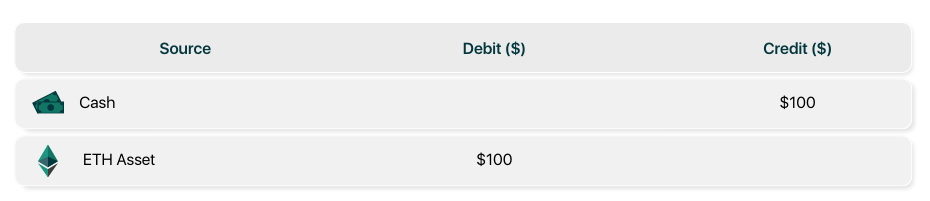

Current guidance - Historical Cost less Impairment

- 5/1 - $100 ETH Purchase

2. 5/31 - market value decreased to $75

.png?width=928&height=199&name=Table%20design%20templates%20(1).png)

3. 6/30 - market value price increases to $200

Under current guidance there would be no entry, her ETH would remain at the $75 book value. GAAP does not allow revaluation on price increases for intangible assets. She would have to continue carrying her ETH at a $75 book value despite market value being $200, highlighting the core issue with today’s methodology. Let’s look at what would change with this new ruling.

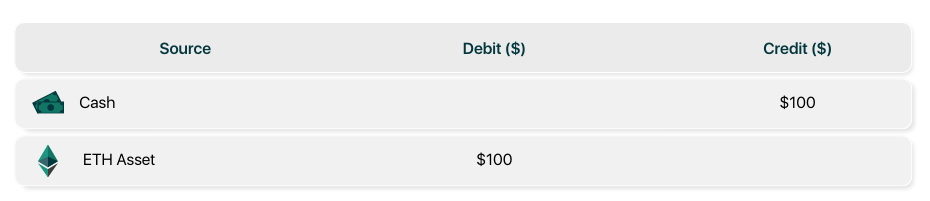

New guidance - Fair Value Measurement

- 5/1 - $100 ETH Purchase

2. 5/31 - Market value decrease to $75

.png?width=927&height=193&name=Table%20design%20templates%20(2).png)

3. 6/30 - Market value increase to $200

.png?width=918&height=255&name=Table%20design%20templates%20(3).png)

Under fair value measurement, Tunde is now able to reflect the true economics of her ETH at $200 on her books. She removes the previously recognized unrealized loss and recognizes instead an unrealized gain of $100. Additionally, she adjusts her MTM by the price change since her last valuation which places it at a balance of $100 on 6/30. Similar to the above, the combination of the two accounts ($100 ETH cost account + $100 ETH MTM account) reflects the $200 market value of ETH as of her reporting period.

This illustration highlights how misaligned today’s guidance is with reflecting the market economics of crypto assets as well as why new guidance will be a game changer for users of crypto financial information.

What are the scope and the timeline for implementation?

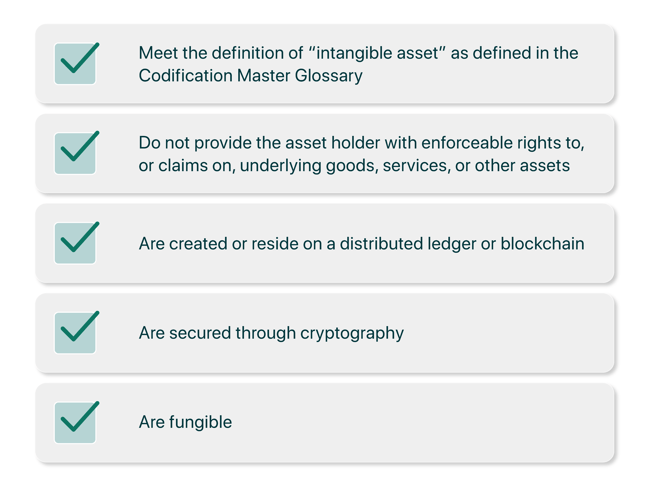

FASB member Lindsey Hoyer gave a reminder in the meeting of the scope requirements that assets must meet to fall under these changes. These are the following:

It is important to highlight that while this scope will cover most traditional digital asset tokens, NFTs are excluded based on the 5th criterion and will likely continue to be valued at historical cost or a variance of that method.

The implementation timeline for these changes is currently uncertain with public expectations ranging from six months to a year. Throughout this process, the FASB will need to reconvene at future dates to finalize the details and disclosures that will come along with this transition.

How does this affect our clients?

No action needs to be taken by companies at the moment. Current guidance will still need to be followed until implementation details are finalized and completed. Cryptio already allows the ability to track and follow assets at their fair market value and is well-positioned to assist our clients in their transition. Companies should separately prepare internally for this change as there will likely be some mild disruption in navigating a new valuation method. We will prepare a transition playbook for our clients to ensure this goes as smoothly as possible.

Key takeaways

This ruling by the FASB is celebrated as a major step in creating clear accounting guidance that will push the industry toward more adoption. One less area of uncertainty that makes the future of cryptocurrencies only more certain.

Want to learn about building a crypto back-office?

Download our comprehensive guide on the best practice to set up accounting and reporting for your business and digital asset.

Sources

Table of contents

- TLDR: What does the announcement mean on a high level?

- What has FASB announced?

- What is the current standard and what exactly is changing?

- What are the scope and the timeline for implementation?

- How does this affect our clients?

- Key takeaways

- Want to learn about building a crypto back-office?

- Sources