Counting crypto: Cryptio's approach to auditable accounting

Accounting and reporting depend on auditable, accurate, and complete data, which is not easy to gather in the fragmented landscape of digital assets. Our blog series reveals our journey to creating accounting and reporting software that solves this problem.

In the second blog of the series, you can learn:

- How Cryptio approaches the challenge of retrieving transaction histories.

- How we build one ledger of truth.

- Our purpose-built blockchain indexers for accounting and reporting.

- Balance discrepancy checks for data reliability.

Summary of Part 1: The challenge of retrieving transaction histories from blockchains

Finding a way to retrieve complete, accurate, and auditable data for accounting and reporting is challenging for any enterprise or institution with crypto on its balance sheet. Many of the solutions on the market, like public block explorers, have limitations when it comes to data reliability and accuracy.

The key to this issue is blockchain indexing. Explorers are not built for enterprise-grade accounting and audits. Purpose-built chain indexers are required.

This is where Cryptio’s proprietary technology can help. Our indexers are purpose-built to return all the data required by accountants, bookkeepers, and auditors to complete their crypto accounting and financial reporting.

Building one ledger of truth

Having evaluated the limitations of block explorers and third-party data indexing companies, we cannot use them for our accounting and reporting software. We can’t compromise on having accurate and auditable data.

At Cryptio, we have a purpose-built solution to retrieve on-chain transaction histories.

Our aim is to bridge the gap between blockchains and legacy accounting systems, such as Netsuite, Xero and QuickBooks, to give our users one ledger of truth.

There are four steps we take in bridging this gap:

- Interpreting on-chain data: for the key information that accountants, bookkeepers, and auditors look for in traditional transaction histories.

- Organizing information into a database: that is filtered for the relevant data for accounting and reporting.

- Transferring relevant information to our platform: where our users can generate reports for accounting, tax, and audit preparation.

- Reconciling the crypto sub-ledger with the general ledger: giving our users one ledger of truth.

Cryptio pulls in reliable data from:

- 13 Layer-1 blockchains: including Bitcoin, Ethereum, Polygon, and BNB Smart Chain.

- Custody solutions: like Fireblocks, BitGo and Anchorage.

- 60,000+ smart contracts, including the most popular DeFi protocols like AAVE, Compound, Uniswap, Sushiswap, and 1inch.

Let’s explore how we build this software from scratch.

Nodes are the immutable source of truth for on-chain activity

Since blockchains are decentralized, there is no central authority to validate transactions. Instead, a network of separate devices, 'peers' performs this function. These devices are called nodes; each maintains a copy of the chain’s entire ledger with every transaction that has occurred.

When a user submits a legitimate transaction, the nodes receive and relay messages to update the sender’s wallet balance. Once a node accepts a new block of transactions, it saves and stores these on top of the existing blocks.

Nodes maintain consensus of all copies of a chain’s ledger and store data of past transactions. They are, therefore, the source of truth for all on-chain transactions.

Building the infrastructure for an accounting data layer

Since nodes are the immutable source of truth, we run our own nodes on different chains. Our nodes record every transaction that has occurred on the chain. With this raw data, we can build a picture of the crypto activity associated with our users’ wallets, giving them one ledger of truth.

With public block explorers and third-party data indexing companies, transactions are often missing. You have no guarantee of data reliability with these solutions since you cannot check for discrepancies within their data. We can perform discrepancy checks and investigate these imbalances by running our own nodes.

Different types of nodes perform different functions. We can select the most appropriate node for our needs by running our own nodes.

Only full archival nodes can retrieve information about token movements and smart contract activity, usually labeled as internal transfers. This type of node stores traces of any event that happened on-chain, including smart contract execution, which is why it can retrieve data about internal transfers. We can therefore retrieve complete and accurate histories for all types of transactions, which is essential for our accounting and reporting software.

Purpose-built indexers for accounting and reporting

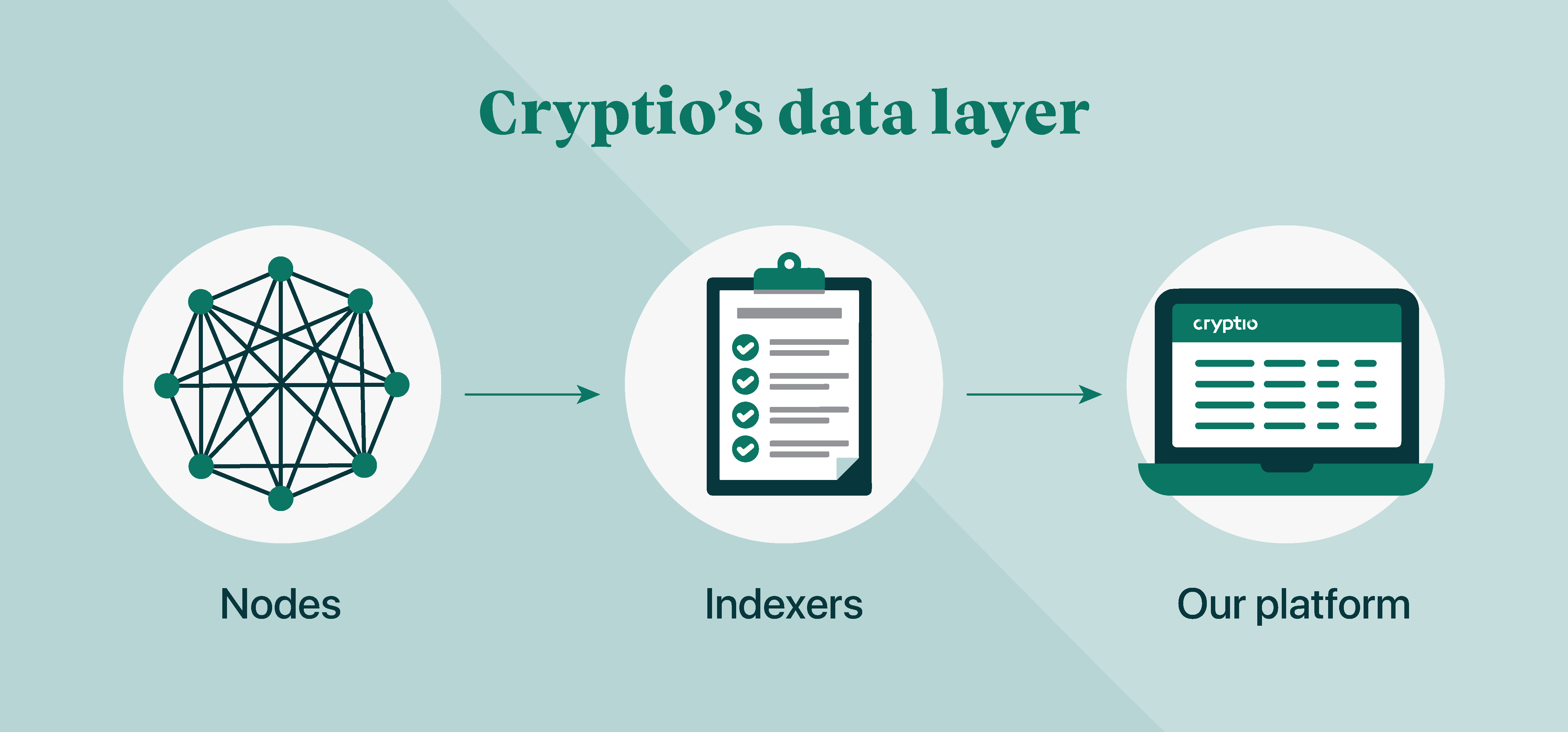

Once our nodes retrieve a complete and accurate on-chain transaction history, this data is processed by our purpose-built indexers.

Public block explorers like Etherscan and third-party data indexing companies do not have indexers purpose-built for accounting and financial reporting. The data, therefore, does not provide the accuracy and completeness required by accountants, bookkeepers, and auditors to do their job.

Our indexers are purpose-built for an accounting and reporting use case. The on-chain data retrieved by our nodes is filtered for just the data required for accounting and reporting, in a process called indexing. This indexed data is then organized into our database.

The indexed data contained in our database is then exposed to our platform by our private API. Users of our platform can view complete transaction histories associated with their different wallets in one place. With this data, they can generate reports for accounting, tax, and audit preparation.

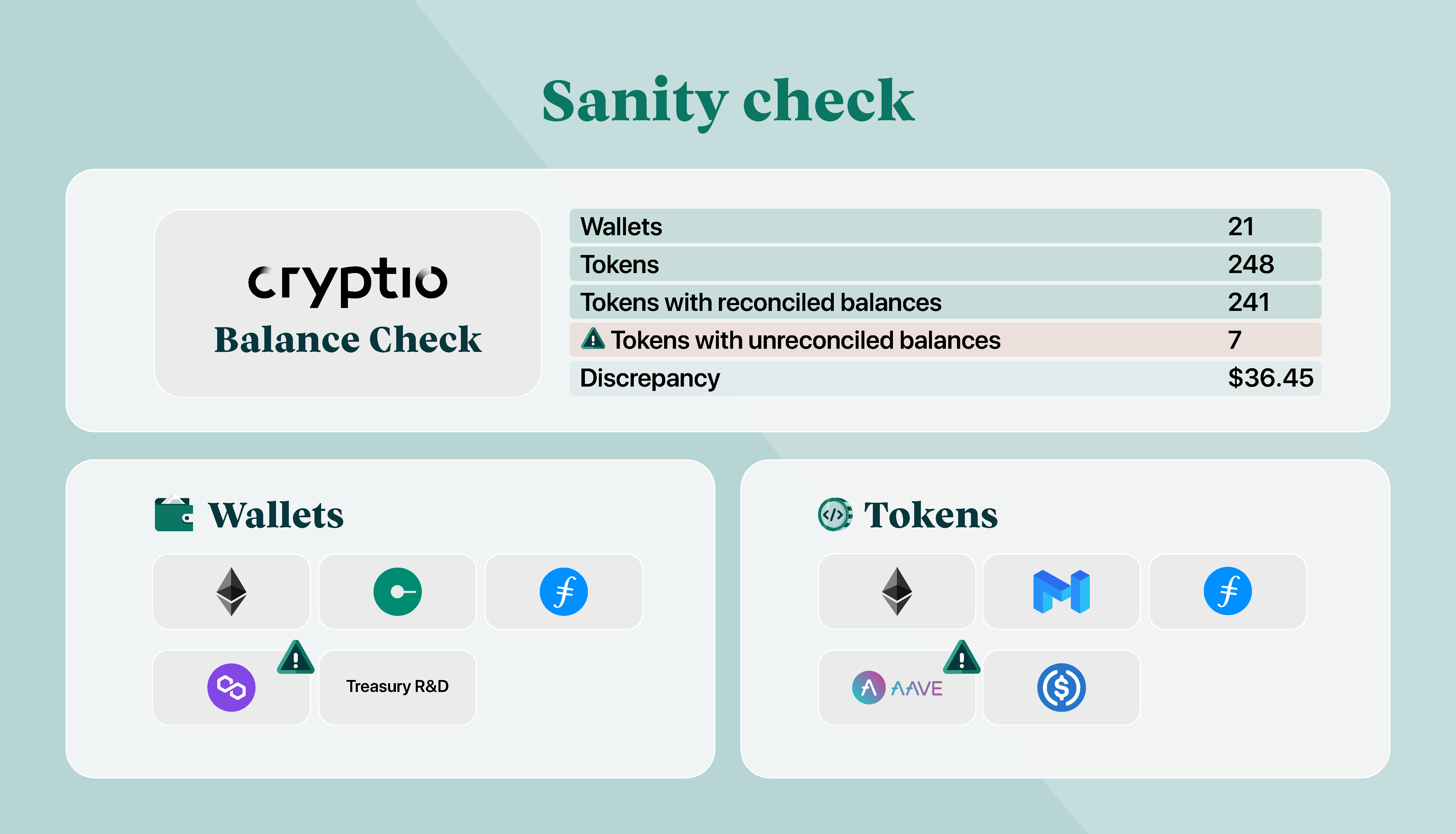

Quality control: Balance discrepancy checks for data reliability

One of the limitations of public block explorers and third-party data indexing companies is that you cannot test the accuracy of their data.

At Cryptio, we perform balance discrepancy checks constantly. When we import indexed data to our platform, we cross-check the balance of returned data with the on-chain balance. Through this discrepancy check, we can establish data reliability and accuracy.

Most crypto tax and financial reporting tools can complete accounting and tax computations. It can be hard to tell the difference at a glance. The difference is that Cryptio is vertically integrated into the data layer, which ensures accurate and complete data – with a full accounting suite on top.

Coming up next in the series Counting Crypto

Stay tuned for the next installment in our series “Counting crypto”. We explain how our users benefit from our purpose-built data stack, including the auditable and accurate data they receive as well as future-proof, adaptable software.

Table of contents

- Summary of Part 1: The challenge of retrieving transaction histories from blockchains

- Building one ledger of truth

- Nodes are the immutable source of truth for on-chain activity

- Building the infrastructure for an accounting data layer

- Purpose-built indexers for accounting and reporting

- Quality control: Balance discrepancy checks for data reliability

- Coming up next in the series Counting Crypto