Top 4 factors when selecting principal markets for valuing crypto assets

Your ultimate guide to selecting a principal market for measuring the fair value of your digital assets.

Fair valuation of digital assets can be a contentious issue – especially for enterprises and institutions looking to pass financial audits. Often, fair valuation data is sourced from the likes of CoinMarketCap and CoinGecko - either directly or indirectly through a crypto accounting software. These pricing data feeds are fairly reliable, however, they have been questioned by auditors - and for good reason.

Selecting a particular principal market for fair valuation is common practice in traditional finance, however, limited data access has meant that digital asset accounting has primarily been built on blended vWAPs. However, this has changed now – enterprises can choose their digital asset valuation principal market and policy.

So, which principal market should you choose? Intuitively, reporting entities go to the markets that have the greatest volume and level of activity for the relevant asset.

However, the decision should consider many factors besides trading volume. Large trading volumes could be a result of manipulative practices such as wash trading or false reporting of trading volumes – something that auditors will pick up. As a financial controller or accountant looking to measure the fair value of crypto assets, you should be analyzing which pricing source is most appropriate for measuring the fair value on an asset-by-asset basis.

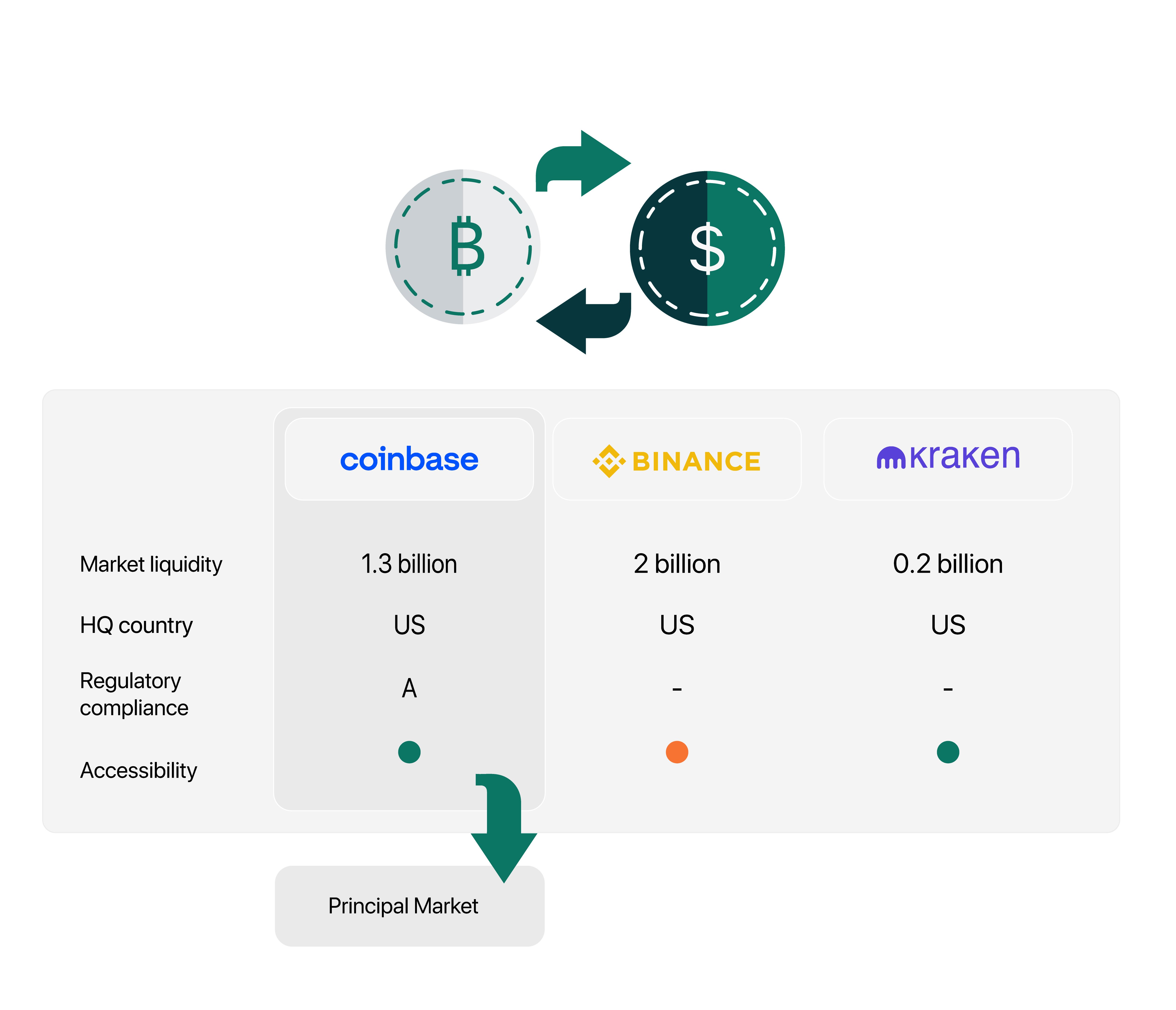

Finance teams can review these 4 factors during the selection process of principal markets to ensure they are making a defensible decision:

- Market liquidity: ensure your chosen market has adequate liquidity for transactions.

- Data reliability: markets with transparent price discovery mechanisms and a reputation for providing accurate and reliable data are ideal choices.

- Regulatory compliance: chosen market must comply with applicable US regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Accessibility: the market should be accessible to stakeholders, with user-friendly platforms and available trading pairs.

This guide helps you understand how best to select principal markets, taking into account important factors like price aggregation, data sources and data quality standards.

Principal market deep-dive: things you need to know

Guidance on selecting a principal market differs slightly between GAAP and IFRS requirements.

If you are following GAAP, you generally account for cryptocurrencies as intangible assets and use the exit price to measure the fair value of an asset.

Under IFRS, they can be classified as intangible assets or financial assets, depending on their nature and use. They both still require the use of the exit price to measure fair value.

Determining the principal market for each asset might be complicated. There might be more than one pricing source that meets the criteria, each of which might give a different price for the same asset at the measurement date.

Pricing providers that have often been used to value digital assets include CoinGecko and CoinMarketCap. Let’s dive deeper into the 4 different factors enterprises and institutions should consider when deciding on a principal market:

1. Market liquidity

A liquid market is essential for accurate fair value measurement since it allows for efficient trading and minimal price slippage.

Here are some key aspects of market liquidity to consider:

Trading Volume: 🔊

The total volume of a specific cryptocurrency bought and sold within a given time period. Higher trading volumes generally indicate higher liquidity, which makes executing transactions easier.

Order Book Depth 📔

The number of buy and sell orders at different price levels for a specific cryptocurrency on an exchange. A deeper order book signifies that there are more orders at various price points, which helps maintain liquidity and minimize price slippage.

- Bid-Ask Spread 📏

The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for a particular cryptocurrency. A narrower bid-ask spread indicates higher liquidity. - Market Impact 🎯

The effect that a large trade has on the market price of a cryptocurrency. In a liquid market, large trades can be executed with minimal impact on the market price. Conversely, in an illiquid market, large trades may cause significant price fluctuations, leading to price slippage. - Market Resilience 💪🏿

The ability of a market to recover from temporary price fluctuations caused by large trades or sudden changes in supply and demand. A liquid market with high resilience can quickly return to its equilibrium price after experiencing price shocks.

2. Data reliability

Relevance and reliability ensure that the fair value measurement of digital assets accurately represents their market value. Let’s look at both in more detail.

- Relevance: The selected principal market should provide relevant pricing information, which means the prices should reflect the current market conditions and be closely aligned with the broader market trends. This ensures that the fair value measurement is useful for decision-making and financial reporting purposes.

- Reliability: The principal market should be reliable, meaning it consistently provides accurate and trustworthy pricing data. A reliable market is less likely to be affected by manipulative practices, such as wash trading or false reporting of trading volumes. Reliability can be assessed by examining the market's historical performance, reputation, and the quality of its data sources.

3. Regulatory Compliance

Regulations around cryptocurrencies differ between jurisdictions, but you should consider both local and international standards when choosing a principal market.

Local regulations may have specific AML and KYC rules, as well as licensing or registration requirements. You must ensure that your selected principal market complies with these regulations.

In addition to local regulations, you should also consider the selected principal market’s compliance with international standards to mitigate legal risks.

4. Accessibility

Your chosen market should be easily accessible by the reporting entity to ensure smooth and efficient execution of cryptocurrency transactions. Here are the top 3 things to consider when looking at the accessibility of your chosen principal market.

- Geographical accessibility: the principal market should be accessible from the reporting entity's location. Some exchanges or trading platforms may have restrictions on users from certain countries or regions, which could impact the accessibility of the market.

- Technological accessibility: the chosen market should have a user-friendly interface, robust technology infrastructure, and reliable customer support to facilitate seamless trading and transaction execution. A technologically accessible market helps minimize potential operational risks and ensures efficient management of digital assets.

- Fee structure and costs: the principal market's fee structure, including trading fees, withdrawal fees, and any other associated costs, should be reasonable and transparent. Lower fees and costs can make a market more accessible and appealing to businesses and investors.

Choosing a principal market on Cryptio

Cryptio’s principal market feature is a key way in which we support customers through their audits.

Users can select their principal market from 20 exchanges, including Coinbase, Binance US, Binance, Kraken, and Bitstamp. We calculate a volume-weighted average price (vWAP) from ‘whitelisted’ exchanges if that is needed.

Cryptio’s principal market feature permits users to see which pricing source has been used for any given asset for any given time. In addition, we have released a report that produces an audit trail of all your assets and the pricing providers that have provided the fair value for each one. As a result, our back-office solution helps users meet the strict audit standards around principal market selection.

Our principal market feature benefits users in a number of ways:

- Flexibility: users can choose the most suitable pricing data providers for a given period for their business.

- Accuracy: users can apply multiple providers on your entire workspace, allowing them to pull in prices from various sources and create a weighted average, providing highly accurate valuation.

- Auditability: users can track the prices for a specific asset across a given time period.

We give our users the flexibility to apply a principal market to either their entire workspace, their entire transaction history or on a specific time period. If you want to learn more about selecting a principal market, read our help center article.

Managing price volatility

To combat the effect of price volatility, Cryptio calculates a 5-minute vWAP for the exchange used as the pricing source for each asset.

If a transaction is listed at the time 10:03, we pull all the transactions for the specific asset that have occurred within the 5 minutes around the transaction. In this case, we would use the time period 10:00-10:05. We then compute the average price of the asset, weighting our average for the volume of each trade.

We can also calculate a 5-minute vWAP for a combination of exchanges if users wish to use a blended price methodology. This enables us to provide our users with the most accurate and precise prices that we can.

The exchanges we can use as pricing sources include:

Across these different exchanges, the price of crypto assets listed on each is determined by the supply and demand within the exchange. When users place orders to buy or sell a cryptocurrency, these orders are added to the order book. Exchanges use an order-matching engine to match and execute buy and sell orders, and the resulting transactions determine the market price of the cryptocurrency on the platform.

As a result, prices may differ across exchanges since their prices are specific to the activity on their trading platform.

Conclusion

When measuring the fair value of crypto assets, finding a pricing source which values the assets you are holding is key. Though guidance suggests that trading volume alone is the key consideration when establishing the principal market, this process depends on various factors.

This guide details the top characteristics you should consider when analyzing different pricing providers, enabling you to make an informed decision about which principal market is most appropriate for your enterprise or institution, whether you are following GAAP or IFRS requirements.

Cryptio’s principal market feature offers users improved auditability since they can select the most appropriate pricing source(s) and track the pricing of individual assets over their entire transaction history. Additionally, Cryptio enables users to pick from the leading principal markets, which all ensure that prices fairly represent market prices and are as accurate as possible.